Apple Marketing Program Report

It all started when...

Marketing Program Report by: Bobby Vincent Bruno

Product:

Apple Inc. offers high-end, high-quality, electronic consumer goods to the public. Their products are backed by a strong brand that also acts as a status symbol.

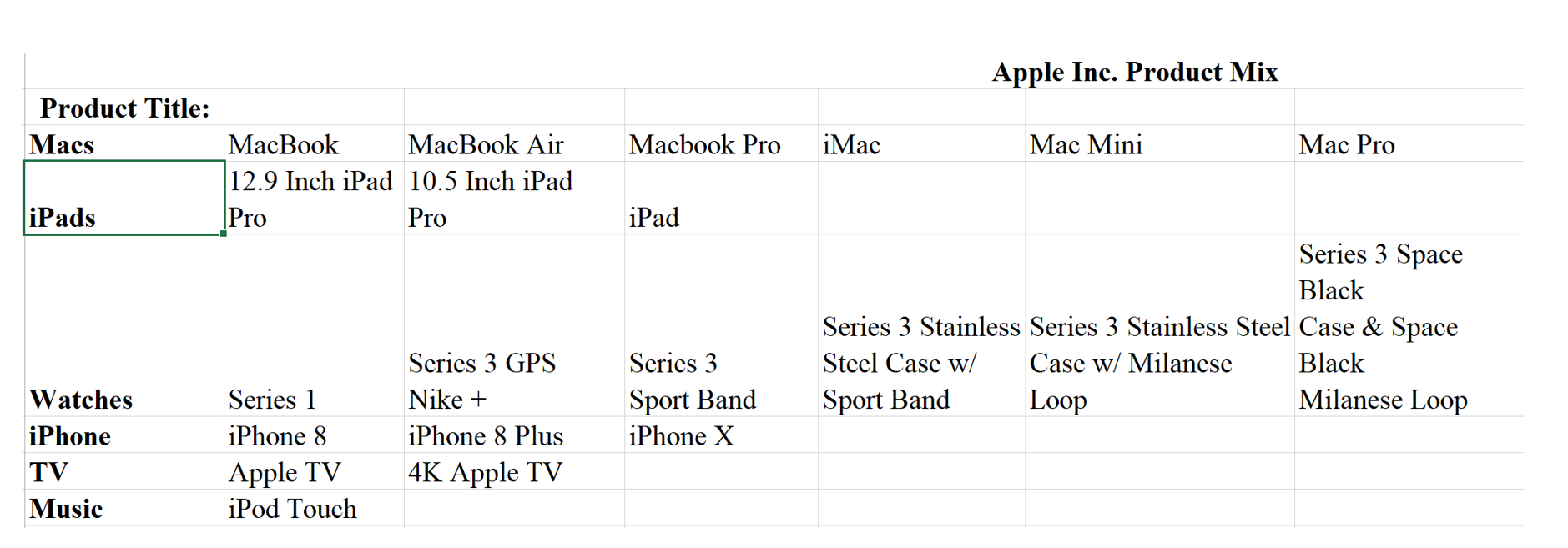

Product Line: Apple Inc. sells a range of products broken up into the following categories – Mac, iPad, iPhone, Apple Watch, Apple TV, and Music (As seen in Illustration 2-1). Each category under Apple’s product categories have a subset of products (product depth) that differ in specs and price. The product mix is shown in Chart1-1.

Chart 1-1

Illustration 2-1

Product Life Cycle:

According to Chart 1-2 provided by Statista.com we can see the quantity of units sold (in millions) for Apple Inc.’s iPads, iPhones, and iPods starting from the 1st quarter of 2006 to most recently the 3rd quarter of 2017.

iPhone: The iPhone made its’ debut in the 3rd quarter of 2007, beginning its’ journey through the product life cycle. During Its’ first quarter the iPhone sold 270,000 units, marking its’ territory in the introduction stage. Since then the iPhone has sold upwards of 1 billion units. Chart 1-2 show continuous growth for iPhones sold. At this point, the iPhone has entered the maturity-saturation stage of the product life cycle. However, there doesn’t seem to be an end in sight for the iPhone, at least not anytime soon. This is one of Apple Inc.’s top sellers in the product mix – so much so that revenue generated from the iPhone is reported independently from other products, which are calculated as a bundle. Additionally, Apple continues to modify the offering for the iPhone. Apple has been successful by implementing the modify offer strategy and with it have created about 16 updates and counting. This strategy is preventing the iPhone from reaching the decline stage of the product life cycle although Tim Cook’s updates (the most recent updates) have been questionable.

iPad: 3 Years after the release of the iPhone (2007) came the iPad in the 3rd quarter of 2010. A light, and portably convenient version of a laptop, that allows users access to the internet, their favorite apps, and more. During the iPads 1st quarter it sold a whopping 3.27 million units (Shown in Chart 1-2) and has continued to grow in sales accompanied by the far and in-between miss in projected sales. The latest release of the iPad took place in 2017 with the title iPad Pro. The iPad has far less updates than the iPhone; however, it is believed to be in the maturity-saturation stage of the product lifecycle along with the iPhone. A strong indication of this is Apple’s need to modify the offer for their consumers and the large quantity that has been pushed out since 2010.

iPods: Apple released the very first iPod in October of 2001 and it sold 125,000 units.1 The number of units sold began to grow every year with new updates and heavy amounts of Research and Development (R&D).2 The iPods last hardware update or modified offer was in July 20153 and in July 2017 Apple cut the price of the iPod Touch. The iPod Touch is currently the only iPod available on Apple Inc.’s website. Additionally, Apple no longer reports iPod sales as an individual revenue generator. Instead, the iPod is bundled in with Apple Inc.’s other services and products. The iPod was once reported individually as it was, at one point, a top seller for Apple. However, the iPod is not in the decline stage of the product lifecycle and is slowly dying out. It seems Apple has made the strategic decision to harvest this offer in order to increase cash flow, and minimize financial and sales allocations to it.

Apple Watch: Sales generated by the Apple Watch are reported in the same bundle as the iPod; however, unlike the iPod, the Apple Watch is in the growth stage of the product life cycle. With the release of the first Apple Watch in April of 2015, the Apple watch is relatively new. The Apple Watch has only seen about 3-4 updates, which is comparatively low. Additionally, the Apple has conducted a joint venture with Nike, in order to release the Apple Watch Series 3 Nike +. This tells me that Apple is looking for alternate avenues to promote the Apple Watch. Therefore, Apple is actively working to increase the sales of the Apple Watch and may one day repost sales of the Watch as an individual revenue generator.

Apple TV: The Apple TV was first released in September, 2006. About 11 years later the 4K Apple TV is finally expected to be released on September 22, 2017. The Apple TV is reported in a bundle along with iPods, the Apple Watch, and other software services Apple offers. This shows that the Apple TV isn’t a lead generator of revenue; however, the 4K Apple TV release, as mentioned previously, marks the first update to Apple’s TV product line. So far there hasn’t been many ads for the Apple TV if any actually exist. This item seems to be running on public relations and news media outlets of which whom had the opportunity to attend Apple’s latest announcement at the new Apple Theater. It seems for about 11 years Apple was harvesting the offer for the Apple TV leading us to believe the offer was in the decline stage of the product life cycle. Now that Apple is releasing an updated version I believe the Apple TV is being given new life and jumping back into the introduction stage of the product life cycle.

Macs: The latest MacBook was released in 2017 with impressive features such as the touch scroll bar and a brand new sleek design. This showcases the company’s use of research and development being allocated towards the MacBook. In addition to the MacBook release it is said that Apple is planning on releasing a new iMac in December of 2017. In addition to the latest and possible future updates Apple has released an updated MacBook every year since 2014. And there has been a new release on the iMac every year with the exception of 2016. This shows that the product life cycle is estimated to be about a year long. With the beginning of Q4 in reach this will mark the maturity-saturation stage of the product life cycle for the last iMac and the time for it to be updated to reenter the market in the introduction stage.

Chart 1-2

Chart 1-2

Chart 1-2

“Apple product sales (IPhone, iPad & iPod) 2009-2017.” Statista

Brands of Apple Inc.

In addition to the master brand, and their Apple branded products (Macs, iPods, iPhone, iPads, Apple Watch, Apple TV) Apple has also acquired other branded businesses. Below are five of Apple’s most notable acquisitions.4

Siri: Apple acquired Siri in 2014 and launched it as a feature for the first time on the iPhone 4S. Siri has been a personal assistant on every iPhone since then.

Beats by Dr. Dre: Beats is a hip and trendy luxury line of high-quality headphones acquired by Apple in 2014.

NeXT Inc.: During Steve Jobs’ exile he started NeXT Inc. to continue his dream and go head to head with Apple. NeXT Inc., a hardware and software company was acquired by Apple and is now in use. Although this business never took off it was well received by its’ customers.

EMagic: In 2002 Apple acquired EMagic, a German company known for its’ music production software since the acquisition Apple has gained over 200,000 Logic users (Apple’s Music Production Software).

Novauris: Apple acquired Novauris to use hand in hand with the iPhones personal assistant Siri. Novauris is an automatic speech recognition (ASR) tech company. This way Siri can clearly understand its’ users.

Brands owned by Apple

Product Branding Strategy

Apple Inc. uses the Multi Branding strategy. More specifically Apple uses the Sub-branding strategy extremely well. All of their products have a unique sub-brand that provides better insight to the offer. Additionally, the Apple logo is on each and every product they sell (under Apple). This makes it easier for consumers to associate the product with the Apple brand. As seen in Strategic Marketing Problem Cases and Comments (152), Pepsico. Owns Gatorade who sells different flavors like Gatorade Rain. Apple Inc. owns the iPhone which is a brand of its’ own and it has sub-branded names such as the iPhone X, and the iPhone 8 Plus. This allows consumers to differentiate various Apple products under the same brand and/or product line.

Line Extension Strategy

Apple Inc.’s line extension strategy can be seen in most if not all of their master brand products. The line extension strategy is implemented through the various specs and slightly altered features of virtually the same product. In order to gain a better understanding of this concept we can view the options to consider if we were planning on purchasing the new iPhone 8.

The iPhone 8 comes with 64 gigs of storage or 128 gigs of storage for a higher price. This strategy is used to satisfy customers with greater or lesser storage needs. This strategy is also seen in the iPhone product line starting around the time of the iPhone 5. Since then they have released the 5C (a more colorful choice) the 6 Plus (a larger screen option), the 6S and 6S Plus (faster phone with added features), the 7 Plus, and the 8 Plus.

Illustration 2-2

Price:

Mac Models & Prices

Apple Watch Models & Prices

iPod, iPad models & Prices

Price Skimming

Apple Inc. uses a price skimming strategy. This is where the price is initially set high, and decreases over time. The price skimming strategy allows Apple to reach the five adopters at a price point where each adopter is willing to pay. To illustrate the price skimming strategy we’ll use the new iPhone X for the example. The iPhone X has just been released for $999 retail for the 64g version. At this price not everyone is willing to purchase the new iPhone. Instead, only innovators and possibly early adopters will be willing to pay the premium price to get their hands on the latest Apple technology. Innovators and early adopters are usually the customers who are waiting in line and pre-ordering the iPhone. Once this segment [Innovators and Early adopters] is served sales will begin to drop marking the beginning of the end for this specific iPhones life cycle. At this point Apple is faced with the decision of decreasing the price to make the iPhone X more accessible in order to reach the other segments of the market. As the price drops continues to drop, early majority, late majority, and laggards will be able to purchase the once new iPhone X. At this point the market for the iPhone 8 has reached maturity and is soon going into decline; however, this strategy is beneficial because it caused the market to reach equilibrium and allowed Apple to reach more customers with the same product over a given set of a time (typically a year to a year and a half for all iPhone updates).

Market Segmentation

Apple Inc. tackles market segmentation in more ways than one. One strategy Apple is using to segment the market is with storage space and a price to match. Apple grants consumers the option to purchase computers, iPads, Apple Watches, iPhones, and more with varying storage space. If a customer needs more storage space they are willing to pay more for it. For those who need less storage space the rule applies, and they pay less for less space.

Another way Apple is segmenting the market is partially shown in the name of some of their products. Some of their products have the name Pro in it, like the iPad Pro, Mac Pro, MacBook Pro. The name itself intensifies the focus on the products’ intended user. Apple products that contain Pro in the product title are targeting professionals in various industries. These people have greater needs as they are using design, video, and other demanding software, sometimes at the same time. They need a reliable iPad, MacBook, or Mac Pro that will allow them the freedom to work how they want with the technology slowing them down.

There is also the MacBook Air, which was released in 2008 and was created to go head to head with Microsoft’s Surface Laptop, which was targeting students. Apple noticed the market segment for college students shortly after Microsoft and answered with a less expensive and lighter, MacBook Air. The price and the lighter design made it accessible for college students to acquire and easier for them to carry from class to class. Apple has also devised a way to segment the market for their Apple Watches. By partnering with Nike, and creating the Apple Watch Nike +, Apple is targeting a fashionably conscious, technologically savvy segment who take fitness and exercise seriously.

Place:

Apple currently has over 500 brick and mortar locations across 18 countries including the United States, where they sell and promote all Apple products and software available to consumers. There latest brick and mortar sites according to Mac Rumors are located in China, Taiwan, and Singapore.5 Apple will continue to grow their retail locations aggressively in Chine, their largest market.6 Along with Apple’s retail locations they also distribute the items through Apple.com a website that offers a plethora of information for all of Apple’s software services and their more tangible products.

In addition to Apple Inc.’s own website and retail location they also have a large list of resellers who are authorized to sell Apple product. These stores consist of big-box and mega stores with an occasional smaller cell phone service and accessory store.

Apple uses an exclusive distribution strategy and only allows authorized stores and locations to sell their latest Apple products. Some of Apple’s authorized resellers include T-Mobile, Best Buy, Wal-Mart, Sprint, and Verizon.

Promotion:

Apple Inc.’s promotion strategies include digital marketing, with an aggressive social media remarketing program. Once a user visits Apple.com they are being tracked and will be targeted by the campaign. At that point the visitor will eventually come across Apple ads on along their social media feeds. Apple also uses their own website to promote their products by dedicating entire web pages to fully explain the benefits of a certain product. In addition to their online marketing efforts they also use billboards. One of their most noticed bill boards hangs off the Brooklyn Queens Expressway (BQE). An ad for their Shot on iPhone campaign is showing Illustration 2-4.

Illustration 2-3

Appendix

1. “Apple Stores.” Everything We Know | MacRumors, 16 Sept. 2017, www.macrumors.com/roundup/apple-retail-stores/.

2. See above.

3. See above.

4. Bryant, Sean. “The Top 6 Companies Owned By Apple.” Investopedia, 25 May 2015, www.investopedia.com/articles/investing/052515/top-6-companies-owned-apple.asp.

5. Michaels, Philip. “Timeline: iPodding through the years.” Macworld, PCWorld, 23 Oct. 2006, www.macworld.com/article/1053499/home-tech/ipodtimeline.html.

6. See above.

Graph - “Apple product sales (IPhone, iPad & iPod) 2009-2017.” Statista, www.statista.com/statistics/253725/iphone-ipad-and-ipod-sales-comparison/. Accessed 19 Sept. 2017.